India’s endeavour in the Dry bulk and tanker industry with regard to its recent developments might affect the freight market

The Open sea team has witnessed several queries for loading and unloading in India ports. This definitely arouses an interest to have a glance at the Indian Economy as a whole. India’s endeavour in the Dry bulk and tanker industry with regard to its recent developments might affect the freight market.

Undoubtedly, India plays a vital role in the global marine industry as its fostering rapidly.

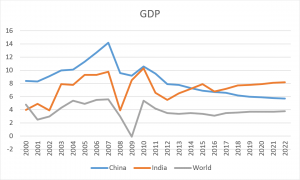

Placed at the sixth rank globally by nominal GDP (about 2.4 trillion estimated for 2017). Also acquiring the position of the third largest interms of the Purchasing Power Parity (about 9.5 trillion estimated for 2017). The country ranks 139th in per capita GDP (nominal) with $2,134 and 122nd in per capita GDP (PPP) with $7,783 as of 2018. India is 16th largest maritime country, contributing vitally for the sustainable growth of trading and commercial sectors.

The composition of cargo managed by Indian ports is estimated as 37% in Oil and petroleum goods, about 23.5% coal, 19.5% containers, 5.5% iron ores, fertilisers were supposed to be nearing to 2.5% while 12% for other minor bulk goods. About 95% of India’s trading in terms of volume and 70% by value is done through maritime transportation. Apart from 12 major and 200 notified minor ports, 6 new mega ports are in the pipeline to be functional.

The Fastest Growing Economy in the world

So, far India is being projected as the speediest economy likely to dominate globally soon. The raw steel production is another economic indicator which shows the industrial activity of a country and which is very significant for the dry bulk shipping.

The emerging ruler in Import

Steel & Iron ore

Iron ore is the main ingredient required to manufacture steel. As per the Clarkson, India imported nearly 4 million tons of iron ore and exported nearly 16 million tons in 2016.

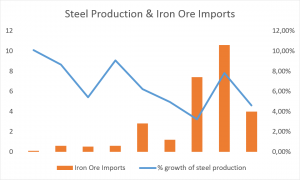

India’s steel production has doubled the last 10 years and during the same time, the imports for iron ore were increased for almost 40 times; from 0.1 million tons in 2008 to about 4 million tons in 2016. The steel production of India has reached twice in past 10 years and during the same tenure, the imports for iron ore and has reached for almost 40 times; from 0.1 million tons in the year 2008 to near about 4 million in the year 2016.As India is among those few countries whose industrialization has increased at the rate of 4% every year.

Its demand for iron ore may reach a peak in coming years if at all its domestic production is also on the increase mode. The diagram indicates the growth of crude steel production of India w.r.t country’s imports during the same tenure.

Coal

Coal is the dry bulk good, with the second largest trading volume globally and India is among the three leading importers, along with China and Japan.

During 2016 India imported 156.2 million tons of thermal coal and 46.9 million tons of coking coal approximately which was reported as 18% of the world coal imports.The table on the next page gives a brief of development of Indian imports since 2010 w.r.t Chinese and Japanese imports as well. The domestic coal production in 2015 and 2016 has kept the imports constant or may be less variable.

However, India is still acquiring the master’s position in the sector. The predictions for 2017 show that the circumstance will be constant for India.

The coal of India is primly imported from Indonesia or South Africa commonly in Supramax and Paramax shipments while in a lesser extend Capesize Shipment of USA coal is imported to the country. The Eastern and the Western ports, both are utilized for the purpose of discharging.

Rice

India has made its stand out position in terms of rice exports beating Thailand. In 2015, 10.23 million tons, in 2016, 9.8 million tons were exported. 29% of world rice was exported in terms of value (in US$). China and West African countries are mainly the buyers of Indian rice being exported either in bags or bulk loaded mainly in handy size or up to supramax bulk carriers.

The major port for the export of rice is Eastern coast is Kakinada. The recent post reflects a drop in the coming days though the position of India will remain intact, as a leader.

Oil

Around 4.3 million tons of crude oil which are equivalent to 11% of world import is imported by India. India is lagging behind only two countries, namely China and USA. Its imports have risen to 16% since 2012 and are predicted to have a further increment in the coming years. This is certainly going to lead the country to grab the second position in the industry.

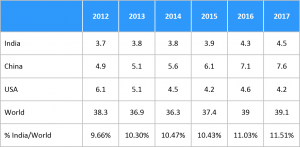

The data below briefs the crude oil imports of India, compared to China and USA. Excluding the imports of crude oil, the export of refined goods remains constant at 6%.

Indian Ministry of Shipping, Road Transport and Highways is keen on putting several efforts to invest in the ports and roads sector. The project also includes investments in manufacturing hubs nearing the ports. These endeavours will extend the new horizons for the country in global trades, leading to a rise in the economy.

INDIA unfolding its Heroism in Dry Bulk

India is fostering its economy at a speedy rate, yet it seems to be far behind China. Despite the positive signs of the country’s growth in bulk shipping.

The steel production growth is of a higher rate, still its only 10% that of China’s steel production. The country’s contribution to EXIM will remain low in iron ores. Though coal levels will remain at high it doesn’t seem to be witnessing further growth in the next few years. The import of fertilizers will be dropped in the coming 3-4 years as per the plans. 2.5% of all the commodities are fertilizers. According to the forecasts, the drop in rice will affect fertilizers by almost 3%.

The infrastructure of ports is under development. Management of huge trade volume is difficult in the present scenario. The expansion of its marine efficiencies is in the process for the country. In short, India is unfolding its heroism in dry bulk shipping globally.

However, a drastic change is not expected presently. The economic growth persists on 8%. The infrastructure of Ports is on the path of modernization, taking India a step ahead to its long-term prospects for arising as a hero of shipping. Undoubtedly, in the trump card of economy dry bulk is an ace of Indian shipping!