Ambiguity mounts in dry bulk shipping against a backdrop of fragile growth in Chinese imports, said BIMCO.

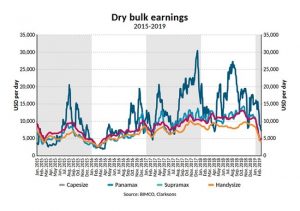

The range of the freight rate recovery in 2018 was definite when compared with the basic expectations by a speedy-growing fleet. Though we know that quarter 4 in 2018 wasn’t as strong as it often is either, but that was merely the beginning of an acute downturn. On top of that, in January 2019, led the way even more down to a massive lack of cargoes. By early February, the industry seemed to be paddling in quicksand,” the reports said. The November dip in Capesize freight rates was just an ill indication of what was to come. For January, there has been no base for Supramax, Panamax or Handysize freight rates; it is as if the market has turned back the clock by two years, reaching at freight rate levels seen in early 2017.

The range of the freight rate recovery in 2018 was definite when compared with the basic expectations by a speedy-growing fleet. Though we know that quarter 4 in 2018 wasn’t as strong as it often is either, but that was merely the beginning of an acute downturn. On top of that, in January 2019, led the way even more down to a massive lack of cargoes. By early February, the industry seemed to be paddling in quicksand,” the reports said. The November dip in Capesize freight rates was just an ill indication of what was to come. For January, there has been no base for Supramax, Panamax or Handysize freight rates; it is as if the market has turned back the clock by two years, reaching at freight rate levels seen in early 2017.

At the levels recorded on 31 January 2019, Handysize, Supramax, and Panamax, had earnings of about $6,000 per day, where as the 180,000 DWT Capesize ships earned only a little more than $11,000 per day. All of them are performing at loss-making levels. A major question is aroused because seaborne transportation is completely priced inflexible. Shipping cannot create higher demand through lower prices. It is simply dependent on world trade. Only persist to focus on removing obstructions to trade and lifting international economic growth can support the demand side of the marine industry.

Chinese dry bulk imports are the major driver on the demand side of the basic balance have exhibited weakness, growing only by an estimated 2.5% in 2018. Minor bulks (like minerals, metals, forest products, and so on) were among the positive drivers, while a large headwind was blasting against grains, soya beans, and iron ore.

For every 10 million tonnes of exports to China that switch away from Brazil to Australia, nine standard Capesize ships will be idle. If 10 million tonnes of exports to China from Brazil are off-track forever, another five will become redundant. Introductory data points show that 3.2m DWT was bought in January 2019, the maximum for a single month since January 2018. January is the month that sees the highest number of launches. Just three ship destructions did little to counter the fleet growth of 0.3%.

As the order book is no longer massive, international shipyards will tend to deliver new build ships nearer to the scheduled dates than usual. Consequently, BIMCO has adapted the slippage rate in its forecasts down to 25% in 2019 from 35% in 2018.

The present level of deliveries forecast for 2021 (16 million DWT) – and assumed on the back of the existing order book only. It shows that interest in establishing new orders has been controlled since the middle of 2014. The only exception is the tenure of September 2017 to January 2018 when freight rates were at their topmost level for a long time.

For the full year, BIMCO assumes a dry-bulk fleet growth of 3.1%, up from 2.9% in 2018. We predict demolition activity will be at a low level. Should our estimate of just 4m DWT exiting the fleet prove too low, an additional 10m DWT leaving will bring the fleet expansion down to 2%, as per the reports.

This sensitivity shows that even a much greater level of demolition – if freight rates stay at the low for a lengthened time – may not be enough to build a turnaround. It may only make sure fleet growth stays on a par with possibly lower demand.

The deliveries scheduled for launch in 2019 involves nine Valemax ships; 52 Very Large Ore Carriers (VLOC); 20 standard Capesize 133 Panamax; 122 Supramax; and 73 Handysize. A speedy fleet growth in 2019, combined with a deteriorating market, means that a broad-spectrum impact will be felt. No sub-sectors will be shielded from the way the market is developing – neither from a growing fleet nor the synchronized freight rate movements.

Calling a market turnaround to excellence is pure luck.

But investigating for pillars that would back a higher level of demand makes sense. First up is the next Brazilian soya bean export season, which might come earlier this year, as harvest conditions have reportedly been agreeable. As a result, we expect to see soya bean cargoes arriving the market as soon as the second half of February, the reports said.